Earnings increase year after year but not making money. Nayuki's listing seeks continued blood develToday's headlines

On the evening of February 11, on the eve of New Year's Eve, a blockbuster news blew up the tea drinking circle and even the entire catering industry-Naxue's tea submitted a prospectus to the Hong Kong Stock Exchange, and officially began to hit the first share of new tea drinks.

However, with the disclosure of Nayuki's tea prospectus, people suddenly discovered that behind the IPO, there is still too much thinking and anxiety left for tea drinkers.

ONE

Three consecutive years of losses

IPO renewal of cash reserves?

The prospectus shows: Nayuki's tea has lost money for three consecutive years!

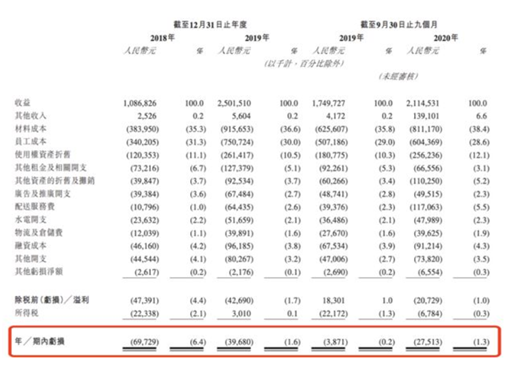

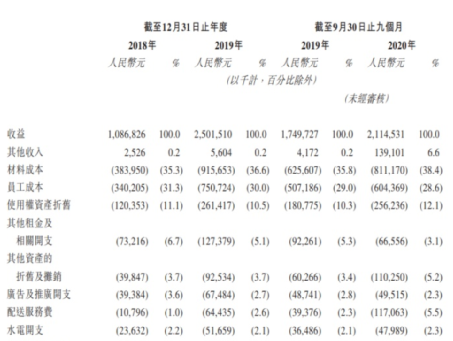

Naxue’s tea revenues in 2018, 2019, and the first three quarters of 2020 were 1.087 billion yuan, 2.502 billion yuan, and 2.115 billion yuan, respectively, with net losses of 69.73 million yuan, 39.68 million yuan, and 27.51 million yuan, respectively, with a total loss 137 million yuan.

Years of losses are seriously inconsistent with the public's perception. After all, Nayuki's tea, as the leading brand of new-style tea drinks, has always been in the people's minds.

Nayuki's tea is a brand that is very much favored by capital.

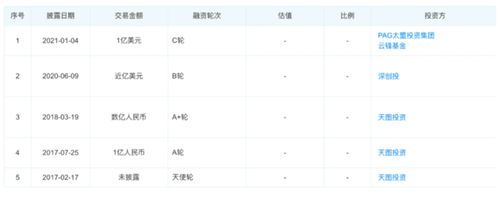

In January 2017, Naixue's Tea completed the A round of investment, amounting to 70 million yuan invested by Tiantu; in August, it received another 22 million yuan of A+ round financing from Tiantu investment.

In 2018, Naixue's Tea signed a B1 round of financing with Tiantu Investment in November, with a total amount of 300 million yuan.

In April 2020, Naxue’s tea received a 200 million yuan investment from SCGC; in June, Naxue’s tea and HLC signed a US$5 million B2 round of financing.

In 2021, on the eve of the IPO, Nayuki's tea received another US$100 million in Series C financing led by PAG Taimeng Investment Group.

After completing the C round of financing, the valuation of Naxue's tea reached approximately 13 billion yuan.

On the one hand, capital favors coupled with good revenue growth is the confidence of Nayuki's tea IPO; on the other hand, the disclosure of the prospectus also makes Nayuki's true financial situation invisible. Nayuki's tea party also stated frankly in the prospectus that the directors believe that it will have sufficient working capital to meet current needs and needs for at least 12 months in the future from the date of this document. Its working capital needs are huge, and it has faced working capital deficits in the past. A large amount of capital is needed to fund its operations and respond to business opportunities. If it continues to face working capital deficits in the future, its business, liquidity, financial condition and operating results may be materially and adversely affected.

TWO

The threshold is not low, the profit is not high

The new tea industry is overthrown?

In many people's eyes, Nayuki's tea losses are even greater than the impact of Nayuki's tea IPO.

In the common perception, the new tea industry is a catering category with low threshold, high profit, easy to standardize, and easy to achieve large-scale operation. But Nayuki's tea has used practical actions to prove that the threshold of new tea is not low, and the profit is far less than imagined.

Is there a mistake in people's perception of the new tea? No, it is the positioning and development tone of Nayuki's tea that determine its high cost.

·Big shops

According to the introduction in the prospectus, Nayuki's tea shops are mainly divided into three types. The first is the standard store type. This is the main store type of Nayuki's tea. This type of store starts at 180 square meters and is generally located in high-end shopping malls or mature business districts in first- and second-tier cities. This type of store includes Nayuki DreamWorks, Nayuki's Gifts, and BlaBlaBar. The second is the newly launched PRO store, with an area of 150 square meters, which is mostly located in the center of high-end office buildings and residential areas; the third is the sub-brand of Nayuki, Taigai, which mainly faces price-sensitive people. Xue's tea revenue contributed less.

Up to now, most of Nayuki's stores are large stores of 180-300 square meters, which seems a bit unique in the field of new tea drinks that pay attention to ping effect. According to the summary of Naixue’s prospectus, Hicha’s current stores are mostly between 150 square meters and 200 square meters, a little bit smaller than Michelle Ice City, mostly small stores below 150 square meters, and Starbucks that pay attention to the third space experience mostly have 150 square meters A large store of up to 350 square meters.

The operation of large stores and the location of shopping malls determine the high cost of Nayuki's rent, but this is not the main expenditure of Nayuki's tea. The staff cost is much higher than the rent cost.

Similar to Starbucks, Nayuki's tea has always followed the "experience" route. It requires large space, fine decoration, and excellent service to highlight the advantages of experience. Today, when digital ordering is popular, Nayuki’s tea still does not cancel the manual ordering service; one shop, one design, "one shop, one scene", fashionable and exquisite design to please the visual experience of customers; even the light-weight PRO shop It is also one of the few "big shops" in the tea industry... The "experience" model has brought high costs to Nayuki's tea, and it is also an irreplaceable advantage of Nayuki's tea.

·High-speed expansion

The prospectus shows that as of 2017, 2018, 2019 and the first three quarters of 2020, the number of tea shops in Nayuki is 44, 155, 327 and 422 respectively.

Nayuki's tea has maintained a rapid expansion rate, and Nayuki's tea shops are all directly operated, which requires stable and high cash flow support. Nayuki's Tea also stated in the prospectus that it will further expand its tea shop network and increase market penetration in the next three years. It is planned to open approximately 300 and 350 new stores in first-tier cities and new first-tier cities in 2021 and 2022, respectively. At the same time, the raised funds will also be used to improve the supply chain and channel construction capabilities, and also to support scale expansion.

·"Fast" new

Some media have reviewed the new rate of Naxue’s tea in 2020, and found that Naxue’s tea has been updated more than 30 times in 2020, and a total of more than 100 new products have been launched. The new products combine classic product upgrades and special products. There are many innovation directions such as festival customization and highlighting product features.

This speed of new development has allowed consumers to maintain a high sense of freshness for Nayuki's tea, and it also means that Nayuki's tea has a higher product development cost.

·Lifting height

In the past two years, Nayuki's tea has also done some "unexpected" things that have important industry significance. For example, by summarizing industry data and looking forward to industry development, we have successively released the "2019 New Tea Consumption White Paper" with the 36Kr Research Institute, and jointly released the "2020 New Tea Consumption White Paper" with CBNData. Another example is to promote the formulation of industry rules. In 2020, Naxue’s tea and Heytea and other leading brands have formed the CCFA New Tea Drinking Committee to plan to establish a new tea industry standard; in February this year, Naxue’s Tea once again took the lead and cooperated. In 11 branch venues, the "Tea (type) Beverage Series Group Standards" (planned) kick-off meeting was held to continue to promote the establishment and improvement of the new tea industry segmentation standards.

THREE

Crowded track

By their own ability

Naxue’s tea prospectus mentioned that according to the information from CZ, the new tea industry has grown rapidly, and the market size of high-end new tea shops has increased from 800 million yuan in 2015 to 15.2 billion yuan in 2020. And it is expected to maintain a strong growth momentum in the near future. The market size is expected to reach 62.3 billion yuan in 2025, with a compound annual growth rate of 32.7%.

On the crowded new tea-drinking track, Nayuki's tea, which is backed by heavy capital, is also struggling. In recent years, the rapid development of the new tea beverage industry is obvious to all, showing a competitive trend of advancing vigorously on the one hand and full of cannon fodder on the other.

·Brand features have their own merits

Some people have always compared Hi Tea with Nayuki's tea. Compared with Hey Tea, Naixue's tea is slightly inferior in terms of store size and revenue capacity, and therefore it has always been the second highest in the industry. In fact, only in terms of brand building and model polishing, Nayuki's tea and Hey tea have their own strengths and weaknesses.

If Nayuki's tea has always been an exquisite modern life attitude, Hi Tea advocates an efficient modern life attitude. While Naixue’s tea has made great efforts at the experience level through large-store scenes and storefront services, Xicha is keen to continuously optimize store efficiency through digital iterative operation model, small program creation, self-pickup stores, etc. Outstanding performance in terms of efficiency.

The different positioning of the two top brands has created their different brand characteristics, but there is no doubt that both have played a leading role in the tea industry.

·Brand expansion stands on top of each other

Naixue’s tea clearly stated in the prospectus that the future expansion direction will still focus on first-tier cities and new first-tier cities, maintaining its "high-end tea" brand tonality. While the teas of Heycha and Naixue were in the first-tier and new first-tier cities, Michelle Ice City and Shuyi Burning Immortal Grass also created a huge chain business empire in the sinking market. Among them, Michelle Ice City The total size of the store has exceeded 10,000.

With Naxue’s tea and hey tea; Michelle Ice City and Shuyi Burning Grass as its representative brands, the new tea drinks have achieved full coverage of the market. The new tea drinks have shown a diversified development trend, and they are also becoming open and inclusive. Attitude attracts all kinds of brands and capital.

The loss of Nayuki's tea has caused people to re-examine the new tea industry, but it cannot be denied that the new tea industry is forward-looking. Similarly, Nayuki is currently in a period of rapid expansion, and the cost increase is inevitable, and Nayuki's hematopoietic ability cannot be denied because of previous losses. On the contrary, the capitals may be interested in Nayuki's tea brand power and the hematopoietic ability behind the product strength, which makes the capital willing to "extend blood" for Nayuki's tea. The capitals foreseen Nayuki's tea that can go further and stand taller.

As far as the industry is concerned, whether Nayuki's tea is successfully listed or not, it has added a blaze to the new tea industry and is an incentive for the industry. Whether Nayuki's tea can become the first new tea drink, it is worth looking forward to!

免责声明:1.餐饮界遵循行业规范,转载的稿件都会明确标注作者和来源;2.餐饮界的原创文章,请转载时务必注明文章作者和"来源:餐饮界www.canyinj.com",不尊重原创的行为餐饮界或将追究责任;3.投稿请加小编微信toutiaoxiansheng或QQ1499596415。4.餐饮界提供的资料部分来源网络,仅供用户免费查阅,但我们无法确保信息的完整性、即时性和有效性,若网站在使用过程中产生的侵权、延误、不准确、错误和遗漏等问题,请及时联系处理,我们不承担任何责任。

扫码关注餐饮界微信号

扫码关注餐饮界微信号

- That little shop on the corner

- The summer of 2021 is coming s

- Lo Mei is more iterative, can

- How can restaurants use "

- Small restaurants can’t do it

- How does Xiaobai start a busin

- Guo Liang, founder of Fork Bra

- With retail catering and colle

- Lo Mei is more iterative, can

- The founder is the brand perso

Media

Media