Haidilao, which has reported huge losses, why is its stock price so strong?Today's headlines

In an environment where the epidemic is very unfavorable to the catering industry, share prices related to hot pot have risen again and again, boiling. For example, Haidilao, which suffered a huge loss in the first half of the year, has continued to expand its stores, and its financial data is not good, but it has a market value of more than 300 billion yuan.

Capital turned a blind eye to the problems behind it, and its enthusiasm was unabated. Why is this boiling hot pot as attractive to capital as it is to diners?

ONE

There are a lot of problems, but capital is optimistic

In 2019, the revenue of 26.556 billion yuan and the net profit of 2.345 billion yuan brought Haidilao's market value of more than 300 billion yuan, and many people were surprised by it.

Many people think this is an overvaluation or a bubble, but the hot pot stock that is optimistic about the market is more than just one in Haidilao:

"The first share of small hot pot" Xiabuxiabu has ushered in a continuous rise in stock prices since the epidemic. The big hotpot brand Coucou has been popular in the market, and its market value has also increased by leaps and bounds. Xiabu’s share price is now at a record high, with a market value of 20 billion Hong Kong dollars, sweeping away the previous decline;

Yasui Foods, which is one of the main ingredients of hot pot, shrimp balls and fish balls, has its share price doubled 11 times after listing, becoming one of the listed companies with the strongest performance in the A-share market in the past two years;

In the Hong Kong stock market, Yihai International, a listed company that specializes in hot pot ingredients, has a market value of more than 100 billion Hong Kong dollars. Not only was it not submerged under the halo of Haidilao, but also relied on innovative products such as Zihai Pot to build a new track, and the meaning of expanding the "quadratic curve" was obvious.

In an environment where the epidemic is unfavorable for the catering industry, the stock price has risen again and again, presenting a scene of prosperity for the entire industry.

Haidilao, which suffered huge losses in the first half of the year, is still expanding its stores and its financial data is not good. The dynamic price-earnings ratio of Yasui Foods is nearly 90 times, and Yihai International exceeds 100 times. Xiabuxiabu reported a half-year loss. These companies seem to have various problems, but what they have in common is that the problems are ignored by capital, and their optimism is beyond words.

In addition to listed companies, unlisted companies are also sought after by capital. At the beginning of the year, Banu Maodu Hotpot received nearly 100 million yuan investment from Tomato Capital, and continued to focus on the high-end hotpot market with "product thinking";

Another startup company, "Guoquan", a hotpot and barbecue ingredients supermarket, has completed 4 financings of 1 billion yuan in a year. Investors include IDG Capital, Jiayu Fund, and Buzhu Venture Capital. In the first October of this year, its offline new stores exceeded 3,300, an amazing speed.

TWO

Haidilao's opponents are also very strong

The impact of the epidemic on the catering industry has many impacts. The waste of food stocks and the consumption of wages for rent and staff are both "bleeding mouths" for enterprises.

Zhang Yong, chairman of Haidilao, said frankly: "This year, I was injured the most. I was killed in nine deaths. During the epidemic, the store was closed every day and the wages had to be paid, so the company would have to pay for it."

On the other hand, the role of service in the development of hot pot restaurants is declining. Haidilao, which once relied on this to attract consumers, has been complained by more people and accepted unnecessary services, and Haidilao itself is also playing down the role of services in its operations.

The impact of the epidemic and the "specialties" of services are no longer needed so much. As the industry leader, Haidilao is not only affected by changes in the external environment and consumer demand, but also seeing rivals rushing in.

Xiabuxiabu, which originally operated a small hot pot, exceeded 1,000 directly-operated stores in 2019, and its operating income reached a record high of 9.30 billion yuan. However, reflected in the stock price, the share price of Xiabuxiabu not only did not rise, but fell instead. It’s nearly 20%.

Beginning in 2016, Xiabuxiabu founded the "Coucuo" high-end hot pot brand, which focuses on the milk tea hot pot party brand. After several years of investment, there will be 107 interim stores by 2020, and the annual revenue in 2019 will be 1.2 billion yuan. In 2020, under the influence of the epidemic, the revenue in the first half of the year will still reach 591 million yuan, showing a clear growth momentum.

Xiabuxiabu, who has long been trapped in the growth of small hot pot, has taken a place in the most valuable hot pot track in the industry. In the Hong Kong stock market, Xiabuxiabu has also become one of the best-performing catering listed companies in 2020, with its stock price rising from a minimum of HK$5.03 to a maximum of HK$19.90.

Xiabuxiabu share price performance (2019-2020)

It is worth noting that in Dianping, the most complained question about Cocoa is not the dishes or the price, but the "long line".

Another company, Banu Maodu Hotpot, is holding the banner of "productism" and taking the high-end route. This strategy emphasizes the characteristics of the ingredients and the exquisiteness of the dishes in order to obtain higher pricing power. At the consumer level, Barnu’s pricing logic is basically accepted.

Baru tries to position its consumers in the elite group of society. These consumers not only have a stronger ability to pay, but also have a very direct willingness to consume: time is precious, and they do not want to wait in long lines like Haidilao and Coucou.

It can be seen that whether it is the original cheap and fast Xiabuxiabu on horses, Haidilao, whose unit price has been rising (from 97.7 yuan in 2017 to 105.2 yuan in 2019), or Banu, who is taking the high-end route, consumes The trend of upgrading is fully reflected.

In this process, Haidilao is limited by its own customer base and business model, it is impossible to take all price levels, and it is impossible to serve all customer groups. The rapid rise of Coucuo and Banu have become the target of attention in the market.

THREE

Hot supply chain

One of the very important reasons why hot pot is favored by capital is that this category is the most easily standardized industry in the catering industry. Compared to chefs, what is more important is fresh and good-looking dishes.

According to the survey data of the 36Kr Research Institute report, the quality of dishes (including vegetables, dried vegetables, frozen goods, etc.) is the most concerned factor for hot pot consumers.

Haidilao realized early on that dishes are the key to the success of hot pot restaurants. Through its large and strict supply chain system and strict management and control, it recruits various distributors across the country.

In addition to purchasing hot pot base ingredients from its subsidiary Yihai International, Haidilao also has a Shuhai company responsible for supply chain procurement and distribution. This company not only has a procurement system, tens of thousands of SKUs, 13 logistics centers, and Own vegetable planting base, beef and mutton processing center.

At the same time, Shuhai not only provides services to Haidilao, but also opens to the outside world, providing supply chain support for fresh ingredients for more than 200 chain restaurants including Jiumaojiu and Xibei.

Anyone who can enter the Haidilao supplier sequence will be confirmed on the one hand, and on the other hand, their own operations and development will also be boosted.

One of the most typical is Anjing Foods (SZ: 603345). This company that produces fish balls and shrimp balls originally only appeared in the frozen food areas of various supermarkets, but the hot pot market has spawned a more popular consumption. The scene, followed by the rise of financial data.

According to data from ECdataway, from February to November this year, the average sales of seafood balls, hand cakes, dumplings and other quick-frozen foods on the Tmall platform increased by 431% year-on-year. Among them, the sales of seafood balls, an important hot pot ingredient, had the highest growth month even as high as 6217.1%, and sales increased by 2582.3% year-on-year.

The non-net profit of Yasui Foods has maintained a growth rate of more than 20% for 10 consecutive quarters, and its operating income has also maintained a growth rate of more than 15% for 6 consecutive quarters.

By the first three quarters of 2020, this company has achieved 340 million yuan in non-net profit by relying on shrimp balls and fish balls one by one. And this is just one of the manifestations of the prosperity of the hot pot industry chain.

Another outstanding feature of the hot pot supply chain industry is that it is gradually transforming from ToB to ToC. The most direct manifestation is that the leading company "pot circle" is popular in the capital market.

Prior to this, Guohuan had accumulated more than ten years of accumulation in the catering supply chain. And in 2013, he created the famous small bench hot pot, and has done a lot of exploration in ToB's hot pot food supply chain, and built its own upstream supply chain resource advantage.

At present, Guohuan cooperates with nearly 600 upstream ODM/OEM factories, and on this basis, it has a logistics system. Through the country's 10 largest warehousing and logistics centers, refrigerated, frozen, and room temperature ingredients can be delivered the next day.

For any hot pot company that wants to attract more consumers, sourcing better ingredients is indispensable. While hot pot is being hailed, supply chain companies benefit very directly.

FOUR

The hot pot scene is changing

The epidemic has restricted the development of hot pot dine-in, but accidentally caused hot pot takeaway and "self-heating pot."

In fact, as early as 2016, a product called "self-heating small hot pot" quietly became popular. In 2017, self-heating hot pot sales began to exponentially increase on various e-commerce platforms.

In 2018, Yihai International launched the self-healing pot on the market, and its sales volume exceeded 100 million yuan less than a year after the first category was launched. One year after listing, since hot pot has become the second largest business of Yihai International, with a growth rate of more than 6 times. Profit attributable to shareholders in 2019 was 719 million yuan, a substantial increase of 201 million yuan compared to 2018.

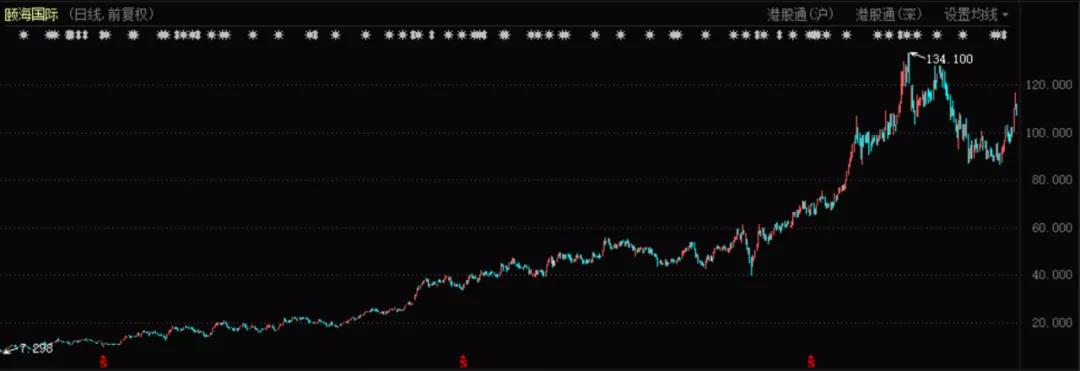

This has driven Yihai International's share price to rise all the way since 2018, from 7.5 Hong Kong dollars to a maximum of 134.1 Hong Kong dollars, an increase of more than ten times. Such market performance surpassed most Chinese listed companies during the same period.

In addition to the steady growth of hot pot bottom material purchases from Haidilao, the rapid growth of branded foods represented by Zihai Pot is one of the important supporting forces for the stock price explosion.

Self-heating hot pot represents the changes in the hot pot consumption scene. The emergence of the epidemic has caused more consumers to start eating hot pot at home through takeaway and purchase of ingredients. From then on, hot pot is no longer a category that can only be eaten in dine-in, and it has become closer and closer to other Chinese food.

Hot pot takeaway is subject to factors such as hot pot scenes, hot pot characteristics, distribution costs, and consumer habits, and has not made much breakthrough. Before the epidemic, very few stores were able to provide takeaway services.

The unexpected epidemic has caused consumers to passively try to eat hot pot at home, prompting the emergence of new hot pot consumption scenarios. Hot pot takeaway has therefore become a new growth point in the industry.

Haidilao’s delivery business accounted for the proportion of total revenue in the first half of the year, rapidly increasing from 1.6% before the epidemic to 4.2%, with revenue exceeding 400 million yuan.

The number of brands joining the hot pot takeaway army has also increased. At the end of September, Hema Xiansheng hot pot was officially launched on Hema Xiansheng nationwide, and was added to the Ele.me platform for sale.

Hot pot take-out and home-cooking make the "one-stop shopping" hot pot food supermarket track, which is born out of the hot pot food supply chain, very hot. Up to now, the leading brand Guoquan Shihui has opened 500 stores in three years; Lanxiong Hotpot Fresh Convenience will open 800 stores in 2020.

Haidilao, which has been building the entire industry chain of hot pot, also participated. In November, Haidilao opened a “food self-pickup store” in Beijing to follow up the hot pot food retail market.

At present, there are more than ten similar hot pot supermarket brands across the country. In addition to the pot circle, there are also new players such as Qizhogui, Chuanxiaobing, Jiupin Guo, and Hotpot Youth.

With the supply of hot pot ingredients as the starting point, there will be some new business opportunities in the hot pot industry in the future. With the ultimate in service, a small and beautiful hot pot segmentation platform similar to "Meicai" will surely emerge in the market.

免责声明:1.餐饮界遵循行业规范,转载的稿件都会明确标注作者和来源;2.餐饮界的原创文章,请转载时务必注明文章作者和"来源:餐饮界www.canyinj.com",不尊重原创的行为餐饮界或将追究责任;3.投稿请加小编微信toutiaoxiansheng或QQ1499596415。4.餐饮界提供的资料部分来源网络,仅供用户免费查阅,但我们无法确保信息的完整性、即时性和有效性,若网站在使用过程中产生的侵权、延误、不准确、错误和遗漏等问题,请及时联系处理,我们不承担任何责任。

扫码关注餐饮界微信号

扫码关注餐饮界微信号

- Catering boss, is the professi

- 3 yuan a bowl of "Brother

- It is difficult for a star res

- In 2021, there is an opportuni

- The listing is coming soon, Na

- Will the Jiumao Jiu sub-brand

- The number of stores broke thr

- The more smelly the hotter, se

- Haidilao has plummeted by near

- With another $250 million in i

Media

Media