Net profit fell by 90%, how can Haidilao "hold stability"?Today's headlines

On the one hand, Haidilao is increasing its store expansion, but on the other hand, its net profit for 2020 has fallen by 90%. But this year, Haidilao’s market value has doubled (currently more than 350 billion Hong Kong dollars), and the founders Zhang Yong and his wife have secured their position as the richest man in Singapore.

Although from a grand strategy point of view, the core of Haidilao is still expanding stores, but Haidilao has to face many challenges. In the face of market competition and the continuous rise of dark horses, such as the exploration of new models, how to extend new brands, etc. .

ONE

Net profit fell by 90%

What happened to Haidilao?

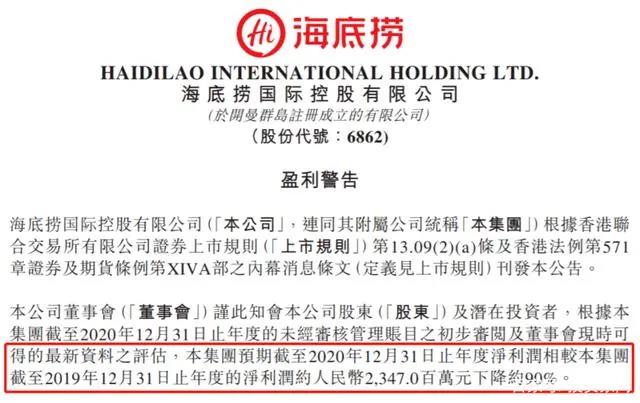

On March 1, Haidilao issued an announcement stating that the net profit for the year ended December 31, 2020 was down about 90% from the same period last year. This means that Haidilao will lose 2.1 billion yuan in net profit in 2020, which is only more than 200 million yuan.

According to the announcement, this loss is mainly due to two reasons. One is the loss of 1.865 billion yuan caused by the new crown pneumonia epidemic; the other is the exchange rate loss of 235 million yuan between the U.S. dollar and the renminbi.

From several perspectives

1. Haidilao's expansion rate is unabated. At the end of 2017, 2018, and 2019, the number of Haidilao restaurants was 273, 466, and 768 respectively. In the first half of 2020, Haidilao opened 173 new stores, and by the end of 2020, the total number of Haidilao stores has exceeded 1,250.

2. In terms of net profit, in 2018 and 2019, Haidilao’s revenue was 16.969 billion yuan and 26.556 billion yuan, an increase of more than 50%. But a 90% decline in 2020 is still unexpected. Haidilao suffered a performance loss for the first time in the first half of 2020, with a net profit loss of approximately 965 million yuan during the period.

3. Both store revenue and turnover rate should have dropped significantly year-on-year. In the first half of 2020, Haidilao restaurants served more than 81 million customers. As of the end of June, Haidilao’s turnover rate had recovered to 3.3 times per day. But the data for the same period in 2019 is 4.8 times. (There is still a certain gap. Of course, it is also related to the vigorously expanding new store.)

4. In terms of market value, it has doubled. Throughout 2020, the market value of Haidilao has increased by nearly 200 billion Hong Kong dollars. As of press time, the market value of Haidilao has reached 355.365 billion Hong Kong dollars.

The author believes that Haidilao is currently facing a balance between expansion and store profitability. Obviously, in 2020, affected by the epidemic, expansion and store profitability will increase. However, we believe that the layout of beach grabs last year was correct. The catering industry as a whole was difficult last year, and Haidilao has even more advantages when it comes to grabbing points offline. As for the decline in net profit, there will be a rebound trend this year, and the performance of market value can also show the confidence of the capital market.

Behind the scenes, we have to look back at the whole market. The cake is big, but the first part of the eater is very few.

TWO

1000 billion hot pot market

CR5 is less than 10%

Previously released by Meituan-Dianping, "Decrypting Consumers' Love Hot Pot" showed that hot pot is the category with the largest market share of dinner, which is as high as 13.7%. In the past two years, the number of hot pot restaurants has steadily increased month by month, with an increase of 34%.

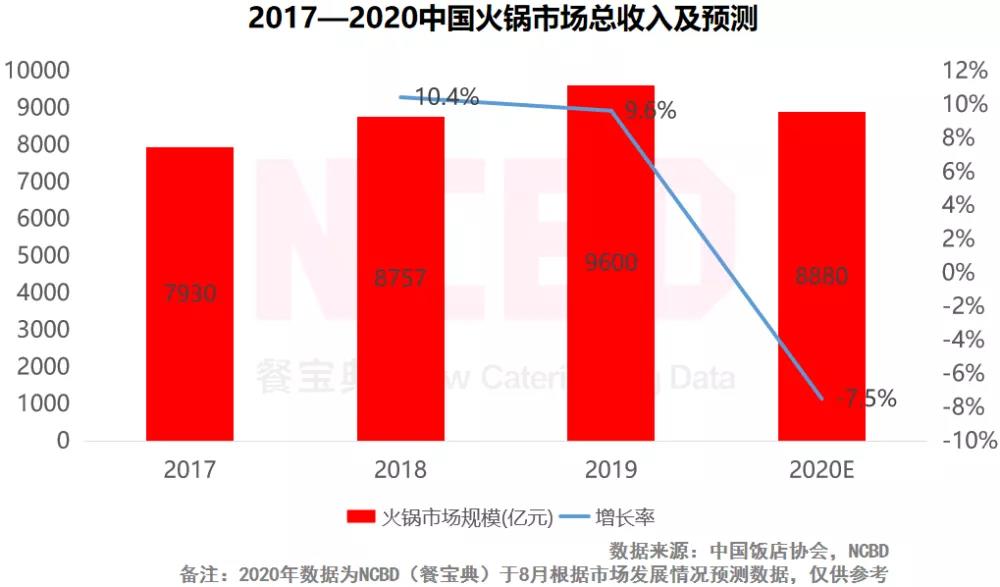

According to the latest "2020-2021 China Hot Pot Industry Development Report" released by NCBD, the total revenue of China's hot pot market is expected to reach 88 billion 800 million yuan in 2020.

Young women are still the main force in hot pot consumption: women account for 57.1%, close to 60%; 26-30 years old account for 30.1%, and 18-25 years old account for 28.1%.

And let’s look at the current development of Haidilao. Although the expansion rate is accelerating and the market share is also the largest, it only accounts for less than 3%. According to its plan, the scope of new stores will be expanded to more than 100 cities, and Haidilao is expected to reach 1,000-1,500 stores between 2020 and 2025. Even if it has 1,500 stores, it still has a small share compared to the 400,000 hot pot restaurants in the national market.

In addition, the CR5 of hot pot markets such as Liu Yishou, Xiabuxiabu, Chaotianmen, and Dezhuang is only 5.5%. It can only show that the current hot pot market, the concentration is too low, the market is still promising.

Taking Xiabuxiabu as an example again, according to financial report data, Xiabuxiabu achieved revenue of 1.922 billion yuan in the first half of the year, a year-on-year decrease of 29.1%; net loss before tax was 311 million yuan; net loss attributable to shareholders was 255 million yuan; The adjusted loss was 192 million yuan.

As of June 30, 2020, the company has a total of 1,010 Xiabuxiabu restaurants, including 364 in first-tier cities and 405 in second-tier cities. There are a total of 107 Cocoa restaurants.

From the perspective of revenue performance, there is still a certain gap with Haidilao. The market value is even worse.

Of course, it also reflects the head position of Haidilao in the hot pot area.

But similarly, Haidilao is also facing longer-term strategic challenges. This challenge not only comes from oneself, but also from the outsiders.

THREE

Which points to aim for?

In addition to offline traffic in the hot pot industry, online takeaways are also growing. At the same time, the hot pot ingredients community stores in new formats have seen a lot of dark horses in the past year. Of course, Haidilao will also think new.

Opening a store in the sinking market is a big increase. At present, Haidilao's income from second- and third-tier cities is increasingly becoming an important part of Haidilao's income, and the income growth rate has greatly exceeded that of first-tier cities.

Judging from the data in 2019, the sinking trend of Haidilao stores is very obvious. In 2019, the number of stores in second-tier cities increased by 60% year-on-year, and the number of stores in third-tier cities and below increased by 65% year-on-year, which is faster than the second-tier cities.

Secondly, this epidemic basically fully stimulated the ability of online catering. In the first half of this year, Haidilao’s delivery business revenue exceeded 400 million yuan. The proportion of total revenue increased from 1.6% in the same period last year to 4.2%, a strong growth. But in fact, this is far from reaching the peak of online potential.

Haidilao’s delivery business is divided into two business service models: self-built stations and affiliated stores. Affiliated stores open take-out business in Haidilao stores, but the operation is undertaken by the delivery team and is independent of the store. As of June 2020, affiliated stores The number reached 299.

The media learned that Hema relies on its online traffic to make hot pot. We look at its results. Since the launch of hot pot in more than 170 stores, Hema hot pot sold more than 10,000 orders per day during Tmall Double 11 last year, with the highest single-day sales of 14,000 pot bottoms, and more than 60% of the orders came from online. It also announced that Hema has surpassed Haidilao to become the largest online hot pot restaurant in China.

There is also the retail road of hot pot. At present, chain convenience stores of various types of base materials and food ingredients have exploded. New players represented by Guoquan Shihui, Lanxiong Hotpot, Banquet Ingredients, Hotpot Story, etc.

Take Lanxiong Hotpot as an example. It mainly sells hotpot bottoms and hotpot ingredients. It has opened 1,200 stores in 2 years. In 2020, GMV will exceed 200 million yuan. The total monthly revenue of all stores is more than 60 million yuan. The interest rate averages 38%, and consumers' repurchase frequency is 3-4 times a month. The performance is very good, and it has also been accelerated by capital.

Guoquanshihui previously completed four consecutive rounds of financing in less than a year, with a cumulative financing amount of over 1 billion yuan. In 2020, it opened more than 5,000 new stores with a valuation of 500 million US dollars.

Haidilao is also being tested and polished. In November last year, Haidilao opened a store in Beijing called "Haidilao Food Delivery Station". This store not only extends the delivery business, but more importantly, in addition to selling hot pot ingredients, it also sells skewers, semi-finished dishes, and retail products such as beef noodles, bibimbap, and sauces. There is no exact operating data yet, but at least it shows that this move has been played.

From a long-term perspective, the retailing of hot pot has a better trend. The "Online Convenience and Fast Food Industry Trend Insights Report" previously released by Tmall shows that fast food/semi-finished dishes are the category with the best growth rate.

Of course, in addition to the above layout, Haidilao also has high hopes for its new catering brands. Xinqin Pai Noodle House, Shiba Bian, U Ding Mao Cai, Lao Pai You Noodles and so on. But at present, most of them are in the early polishing stage.

The hot pot track is the foundation of Haidilao.

On the one hand, expansion, while stabilizing the turnover rate and revenue capacity of a single store, is the core.

免责声明:1.餐饮界遵循行业规范,转载的稿件都会明确标注作者和来源;2.餐饮界的原创文章,请转载时务必注明文章作者和"来源:餐饮界www.canyinj.com",不尊重原创的行为餐饮界或将追究责任;3.投稿请加小编微信toutiaoxiansheng或QQ1499596415。4.餐饮界提供的资料部分来源网络,仅供用户免费查阅,但我们无法确保信息的完整性、即时性和有效性,若网站在使用过程中产生的侵权、延误、不准确、错误和遗漏等问题,请及时联系处理,我们不承担任何责任。

扫码关注餐饮界微信号

扫码关注餐饮界微信号

- With a valuation of tens of bi

- Is the catering brand sinking,

- Will the Jiumao Jiu sub-brand

- Haidilao, which removes beef c

- Naixue’s tea is on the market,

- How can restaurants use "

- Haidilao, which has reported h

- Haidilao's 2020 earnings repor

- How to use the scene to enhanc

- 800 billion, 500 million users

Media

Media