800 billion, 500 million users, the food delivery is still breaking out?Today's headlines

Takeaways have maintained a relatively high growth rate in recent years. Based on the changes in the market environment, we need to think more: How big is the volume of takeaways? Where do the new consumer groups come from? How does the takeaway get out of the "circle"?

ONE

500 million people more than 800 billion yuan, more than 17.12 billion orders

According to the latest data, the number of foreign users sold in my country is close to 500 million. By the end of 2020, the number of takeaway orders nationwide has reached 17.12 billion, and the national takeaway market will reach more than 800 billion yuan. (This data is 653.6 billion yuan in 2019). my country's food delivery industry is expected to develop into a trillion-scale market in the next 1-3 years.

From the category point of view. It is estimated that online catering will account for more than 20% of the entire catering industry in 2020. In addition to the traditional three meals a day, afternoon tea and supper have become new demand points and have also been favored by consumers.

From the perspective of consumer groups and regions. Post-80s and post-90s have become the main force of takeaway consumers. The consumer penetration rate of food and beverage delivery in my country's first-, second- and third-tier cities has reached 96.31%.

TWO

Merchant-platform side-consumer, three parties see changes

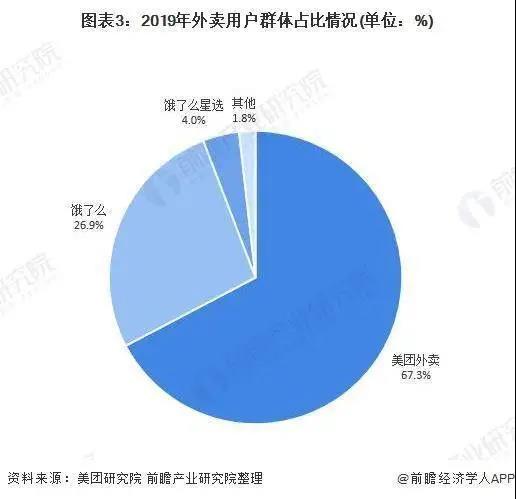

According to our insights in the field of foreign sales. Consumers, platform parties and merchants (mainly in the catering industry). The basic relationship chain has formed a stable structure. The food delivery platforms Meituan and Ele.me have already accounted for more than 80% of the market. It's hard to shake again. However, the development trend of the market is still variable.

For businesses, walking on two legs online and offline. But for brand merchants, it is necessary to think about the long-term layout.

It is inevitable for restaurants to go online for takeaway. When the epidemic broke out in early 2020, well-known catering brands such as Xibei and Laoxiangji all went online. As of the end of 2020, subject to industrial and commercial registration, more than 670,000 new takeaway-related companies have been added this year, a year-on-year increase of 1487%.

However, we also found that many leading catering companies still only account for 1%-20% of takeaway.

There will be some changes in 2020. From the perspective of Haidilao, its 2020 interim performance report shows that in the first half of 2020, Haidilao achieved revenue of 9.76 billion yuan. In the first half of the year, Haidilao’s delivery business revenue exceeded 400 million yuan, and its share of total revenue increased from 1.6% in the same period last year to 4.2%.

We believe that the take-out track must increase its proportion, and build a three-dimensional ability to carry risks. In terms of channels, on the one hand, it is the traffic of the platform, which is still the largest one at present, and the private domain traffic. For brand merchants, they can build their own takeaway malls.

Platform side. Meituan and Ele.me have occupied 90% of the market. The border will be widened in the future.

According to Meituan’s three-month performance report as of September 30, 2020 announced on its website. Meituan’s operating profit in the third quarter reached RMB 6.7 billion, an increase of 364.6% compared to the same period last year. Among them, food and beverage delivery accounts for nearly 60%.

From the perspective of market competition. Meituan and Ele.me account for over 90% of the user groups.

Recently, the E-commerce Research Center of the Net Economics Agency released the "November 2020 E-commerce APP Monthly Live Data Report" online food delivery TOP5 for Meituan Waimai, Ele.me, Baidu Waimai, Meituan Crowdsource, and Hummingbird Crowdsource.

The market space is still large, and several leading companies are constantly breaking the boundaries of food delivery. In terms of food and beverage alone, according to Meituan CEO Wang Xing, China’s urban population is 860 million. Based on three meals per person per day, 2.5 billion meals are required per day. The combined penetration rate of the two companies in the industry is only 2 %, the growth potential is great.

As far as consumers are concerned, considering the health, efficiency, and cost-effectiveness of external sales, segmented scenarios and tiered consumption have also begun to appear.

From the perspective of the crowd, due to the convenience of takeaway and the diversity of samples, takeaway users mainly include high-paying white-collar workers. Their hourly salary is often more than 100 yuan, and they are busy with work and have no time to cook; secondly, they are urban college students who are relatively homeless and do not like it. Go out and wait. According to Meituan data, in 2019, the post-90s and post-00s takeaway users accounted for more than 60%.

We also have insights that food delivery will gradually emerge at different levels, such as high, middle and low consumption levels, and the average customer unit price of food delivery in various cities is also significantly different. There is also the emergence of more subdivided consumption scenarios.

THREE

Takeaway must become a "new format"

So in terms of the current development of food delivery, we think there will be five new ideas and directions.

1. Consumers become more and more "lazy", and the stickiness of the platform will become stronger and stronger.

At present, this consumer's dependence on foreign sales platforms will continue to grow stronger. The structure of the takeaway market monopolized by the two giants is also difficult to change in a short period of time. There are not many opportunities for new entrants.

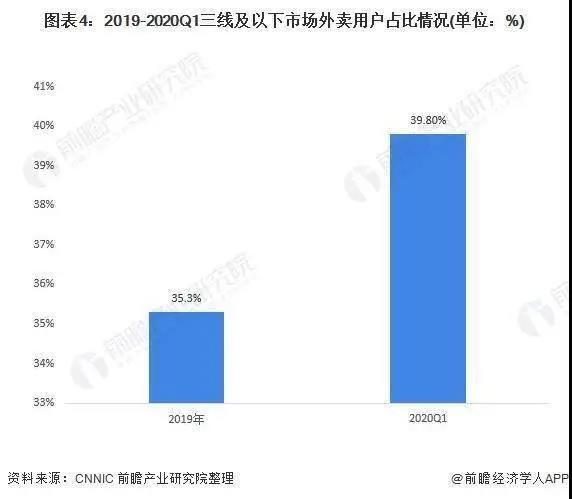

2. Takeaways attack the sinking market.

Takeaways in first-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen have been through competition after rounds of competition. At present, they are basically saturated. Therefore, we can see that Meituan and Ele.me also set their sights on the sinking market (that is, the third-tier cities and below) at the same time.

For example, Ele.me has no longer mentioned the goal of over 50% market share in the short-term and medium-term. Instead, “sinking” is the core strategy of Ele.

Meituan also said that in the next few years, the catering in first- and second-tier cities will sink and penetrate into third-, fourth- and fifth-tier cities, just like KFC and McDonald’s infiltrated from first- and second-tier cities to third-, fourth- and fifth-tier cities.

3. Fast delivery is both a threshold and a pain point.

In general, the delivery time we experience takes about 30 minutes from placing an order to receiving it. These 30 minutes are a big blow, especially for catering. Both the taste of the dishes and the waiting experience of consumers are greatly reduced. Therefore, who can deliver food to consumers in a shorter period of time is the real solution to consumer pain points.

Previously, Meituan launched a new brand "Meituan Delivery", and then Ele.me announced the independence of its instant logistics platform "Hummingbird" brand. At the same time, it is also experimenting with big data and new technology delivery. The average delivery time of orders has been shortened to less than 30 minutes, or even less than 20 minutes. In this part, whoever goes ashore first has an absolute advantage.

4. The new middle class will become the main force of consumption, and the unit price will be higher.

Consumer big data shows that people are more daring to spend money online.

Behind this is the rise of the new middle class. Most of them are well-educated and live in domestic first- and second-tier cities with an annual income of more than 100,000. The pursuit of a quality and attitude of life is the characteristic of the new middle class. According to the Boston Consulting Group, the main force of Chinese consumption in the next five years will be composed of the upper middle class and the new generation.

Therefore, in the choice of external sales, price is often not the primary influencing factor, but early adopters, convenience and health.

5. More categories + takeaways will appear.

Catering is the main force of takeaway, but now we find that more and more categories can be added to takeaway to bring a big increase.

For example, some of the convenience stores we have come into contact with before began to sell through the takeaway platform, and their performance has improved significantly. Of course, in addition to these, there are also flower shops, red hotels, fresh fruits, daily necessities, medicine and even clothing that can be taken out (for example, Meituan previously cooperated with Hailan House to deliver clothes for takeout). The dean of the Meituan Research Institute previously stated that “food delivery is being upgraded from a new model to a new format.”

In our view, the "takeaway" of nearly 500 million users has huge potential.

免责声明:1.餐饮界遵循行业规范,转载的稿件都会明确标注作者和来源;2.餐饮界的原创文章,请转载时务必注明文章作者和"来源:餐饮界www.canyinj.com",不尊重原创的行为餐饮界或将追究责任;3.投稿请加小编微信toutiaoxiansheng或QQ1499596415。4.餐饮界提供的资料部分来源网络,仅供用户免费查阅,但我们无法确保信息的完整性、即时性和有效性,若网站在使用过程中产生的侵权、延误、不准确、错误和遗漏等问题,请及时联系处理,我们不承担任何责任。

扫码关注餐饮界微信号

扫码关注餐饮界微信号

- Naixue’s tea is on the market,

- Popular fast food with iron hi

- Small restaurants can’t do it

- Low exploded Henan Ramen out o

- 4 simple steps, let the restau

- How to make a brand? The fun m

- 800 billion, 500 million users

- How to do social marketing in

- Haidilao and Xiabu have fallen

- Haidilao's 2020 earnings repor

Media

Media