Haidilao and Xiabu have fallen off the cliff, making it more and more difficult for the hot pot markToday's headlines

Recently, the hot pot arena is not peaceful.

First, Xiabuxiabu’s revenue and net profit both fell, and personnel turmoil; second, Haidilao’s turnover rate hit a new low in recent years, and its market value evaporated 240 billion in four months. Zhang Yong admitted: “I’m wrong about the trend”...

Top hotpot brands have suffered successive setbacks. Apart from the treacherous conditions in the capital market, what is the status of the hotpot category?

ONE

No. 1 in order volume & search volume

Sit firmly on the top of the category

1. Online orders accounted for 27.2%, 2.5 times the second place

According to Meituan data, the top three online orders in 2020 are hot pot, barbecue and Sichuan cuisine. Among them, hot pot online orders accounted for 27.2% of the total proportion of catering, and it was the second place for barbecue (accounting for 8.6%). Times.

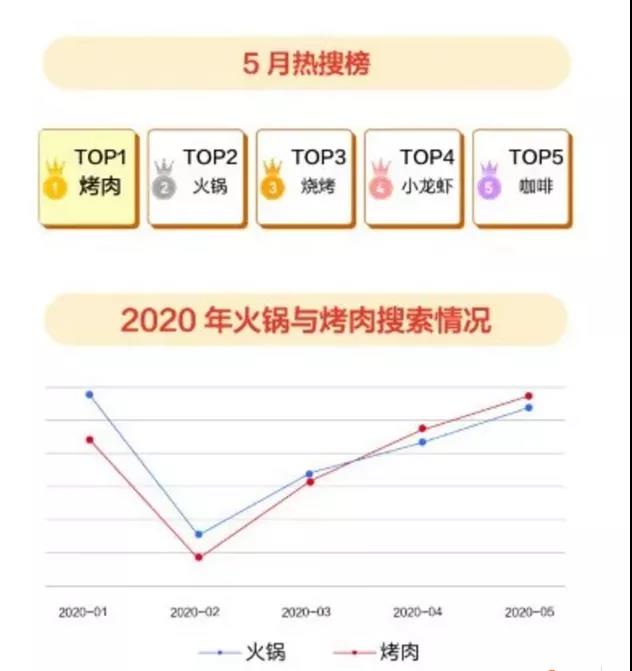

At the same time, search popularity also steadily occupy the first place. It's just that the growth rate is mediocre, and it is left behind by barbecue and milk tea.

2. The chain rate reached 18.3%, which was 3.3% higher than the average

Affected by the epidemic in 2020, the number of hot pot stores has dropped significantly, but the number of chain stores has risen against the trend. The hot pot chain rate has increased from 15.1% in 2019 to 18.3%, exceeding the average chain rate of the catering industry (15%).

Among them, the proportion of chain brand stores with a scale of more than 100 stores has increased significantly, from 12.7% in 2019 to 16.2%. The number of chain brand stores with a scale of 50-100 stores has not changed slightly. The number of large-scale brand stores declined, falling below 70%.

TWO

Top brands march forward and open new stores

Net profit fell precipitously

The increase in chain rate can be seen in the expansion of top brands.

At the end of 2020, the total number of Xiabuxiabu stores reached 1061, of which 91 Xiabuxiabu and 38 Coucou were newly opened during the 2020 epidemic.

Haidilao opened nearly 300 new stores in 2019. In 2020, during the epidemic period, it will continue to make great progress. There will be 544 new stores opened, and the number of global stores will reach 1,298. In 2020, there will be as many new stores opened as in the past 25 years.

However, the market’s response was not so optimistic. Xiabuxiabu’s revenue in 2020 was 5.455 billion yuan, a year-on-year decrease of 9.5%; total profit was 1.837 million yuan, a year-on-year decrease of 99.4%; Haidilao’s turnover rate dropped from 4.8 to 3.5. The annual revenue was 28.6 billion yuan, a year-on-year increase of 7.8%; the annual net profit was 309 million yuan, a year-on-year decrease of 86.8%.

Haidilao’s founder Zhang Yong’s recent remarks revealed the reason why Haidilao has soared during the epidemic: “In June 2020, I judged that the epidemic would end in September, but until today, our stores in Taiwan and Singapore are still Affected by the epidemic, I can’t open it. My judgment on the trend was wrong. In June last year, I made further plans to expand the store. Now it is indeed blind and self-confident. When I realized the problem, it was already in January this year. I waited for my response. It was already March."

Is the failure of the top brand a case or a metaphor for the hot pot category?

THREE

The hot pot market is getting saturated?

Judging from the market data, hot pot is still the deserved No. 1 category: No. 1 in order volume, No. 1 in search, No. 1 in chain rate.

But looking closely at other dimensions, I found that other categories have already outperformed hot pot: Meituan data shows that in April or May 2020, just after the epidemic eased, the search volume for barbecue overwhelmed hot pot and became the number one search.

Barbecue has also become the category that has recovered the fastest in the catering industry during the epidemic.

According to Meituan's "China Catering Big Data 2021", the trend of barbecue orders in 2020 is steeper than that of hot pot and the overall catering market. In November 2020, online barbecue orders increased by more than 100% year-on-year in November 2019.

In the first half of 2021, hot pot related searches continued to decline, with barbecue and barbecue ranking the first in search volume and the first in growth rate respectively.The stock represents the past, and the increase heralds the future. It may become more and more difficult for catering people to make money in the hot pot market.

FOUR

What are the trends emerging in the catering industry?

Although hot pot is firmly in the top position in the industry, there are not many opportunities left for ordinary catering people. What trends are in the catering industry?

1. Barbecue has categories and no brands, and it is in the barbaric growth stage

Although it is the second largest category of catering, the chain rate of barbecue is far lower than 18.3% of hot pot, and also lower than the average of 15% of the catering industry, which is only 9.4%.

Barbecue has a market size of 220 billion yuan, but there has never been a real head brand. There are not more than 300 stores in the country, such as wooden house barbecue and Fengmao skewers.

The chain rate is low, there is no top brand, and the growth is rapid. Barbecue is in the barbaric growth stage.

At the same time, the standardization of barbecue is second only to hot pot. If there is a bottleneck in the supply chain of skewers and marinating in the skewers restaurant, the barbecue can almost completely copy the standardization and supply chain of hot pot, and the "roasting" is more rich than the "shabu" taste. , More likely to be addictive.

2. Capital prefers snacks and drinks, and snacks are no longer "small"

In 2021, capital's investment frequency and investment amount in snacks and drinks have both hit record highs, and snacks have become a popular outlet for well-known capital.

Recently, Ma Jiyong Beef Ramen was given a letter of intent for investment of more than 1 billion yuan by Sequoia Capital. Two other ramen restaurants also received financing.

In April, Chen Xianggui completed an angel round of financing. The investment institution is Source Code Capital. Recently, he is seeking financing at a valuation of 1 billion yuan; Zhang Lala also received an angel round of investment from Jinshajiang Ventures and Shunwei Capital in April. Ten thousand US dollars (approximately 390 million yuan) valuation for a new round of financing.

Wenheyou, known as the "snack comprehensive mall", also recently received a round B financing with an investment of 500 million yuan from Sequoia China Fund, IDG, and Warburg Pincus. The valuation of Wenheyou in this round exceeds 10 billion yuan. .

At the same time, there are also Kuafu fried skewers, Shengxiangting of the hot brine brand, Chongqing Noodle Shop Met Xiaonian, etc., all of which have received more than 10 million yuan in investment, and their capital is also a well-known organization.

The once inconspicuous snacks are no longer "small" under the blessing of the capital halo, and with the more mature and large-scale operation of the supply chain, the snack track is becoming more and more lively.

3. China is entering the era of thousands of stores, and there are traces to follow for major chains

In the Wandian Club, there are Zhengxin Chicken Chop, Wallace, Juewei Duck Neck, Yum China, and Michelle Ice City, which opened 20 stores every day and quickly exceeded 10,000, and Shaxian County, which has no unified brand but strong public recognition. Snacks and Lanzhou Ramen.

Among the 5,000-10,000 store scale levels, there are Yang Guofu Mala Tang and Zhang Liang Mala Tang, as well as the book that opened 1,800 new stores in 5 months and quickly exceeded 5,000 stores.

With the explosive growth of direct sales and franchise giant brands, and the sinking of catering in first-tier cities to the strategic location of N-tier cities, the path of large chains has become traceable, and Chinese catering is entering the era of "thousands of stores"!

免责声明:1.餐饮界遵循行业规范,转载的稿件都会明确标注作者和来源;2.餐饮界的原创文章,请转载时务必注明文章作者和"来源:餐饮界www.canyinj.com",不尊重原创的行为餐饮界或将追究责任;3.投稿请加小编微信toutiaoxiansheng或QQ1499596415。4.餐饮界提供的资料部分来源网络,仅供用户免费查阅,但我们无法确保信息的完整性、即时性和有效性,若网站在使用过程中产生的侵权、延误、不准确、错误和遗漏等问题,请及时联系处理,我们不承担任何责任。

扫码关注餐饮界微信号

扫码关注餐饮界微信号

Media

Media